- Rustic Flute

- Posts

- 👀 Behind the Deals

👀 Behind the Deals

Hey there! 👋

Have you ever wondered what goes behind an investment deal? In the fast-paced venture capital world, investors make high-stakes decisions based on potential rather than proven success. 💼💡

Today, we're pulling back the curtain on two intriguing deals: Glean, an AI-powered enterprise search startup from Silicon Valley, and Razorpay, a fintech innovator from India. We'll explore how investors evaluated these promising startups, what metrics they considered, and why they decided to bet on these game-changing visions. 🚀

Let's dive into the fascinating world of startup investments. 🌟

Glean - The AI-Powered Search Wizard 🧙♂️

Picture this: It's 2019, and four tech wizards decide the world needs a better way to find stuff at work. Enter Glean, the brainchild of Arvind Jain and his merry band of ex-Google geniuses. 🧠

Their mission? Make enterprise search so bright that it'll make Sherlock Holmes jealous.🕵️♂️

But what makes Glean so unique? 🤔

Imagine having a super-smart assistant who knows every nook and cranny of your company's digital world. 🌐 Slack messages from two years ago? Found. That elusive Figma design? Located.The secret recipe for the office's legendary coffee? Okay, maybe not that, but you get the idea.

🔍Let's explore why investors are so enthusiastic about Glean:

💡Exceptional Leadership: Led by Arvind Jain, a former distinguished engineer at Google, the team brings extensive experience in search technology and software development.

⏰Market Timing: With the rise of remote work, efficient information retrieval has become more critical than ever.

🤖AI Innovation: Glean goes beyond basic search, offering predictive capabilities for customer opportunities and interactive Q&A features.

🔒Robust Security: The platform maintains strict data permission controls, protecting company information.

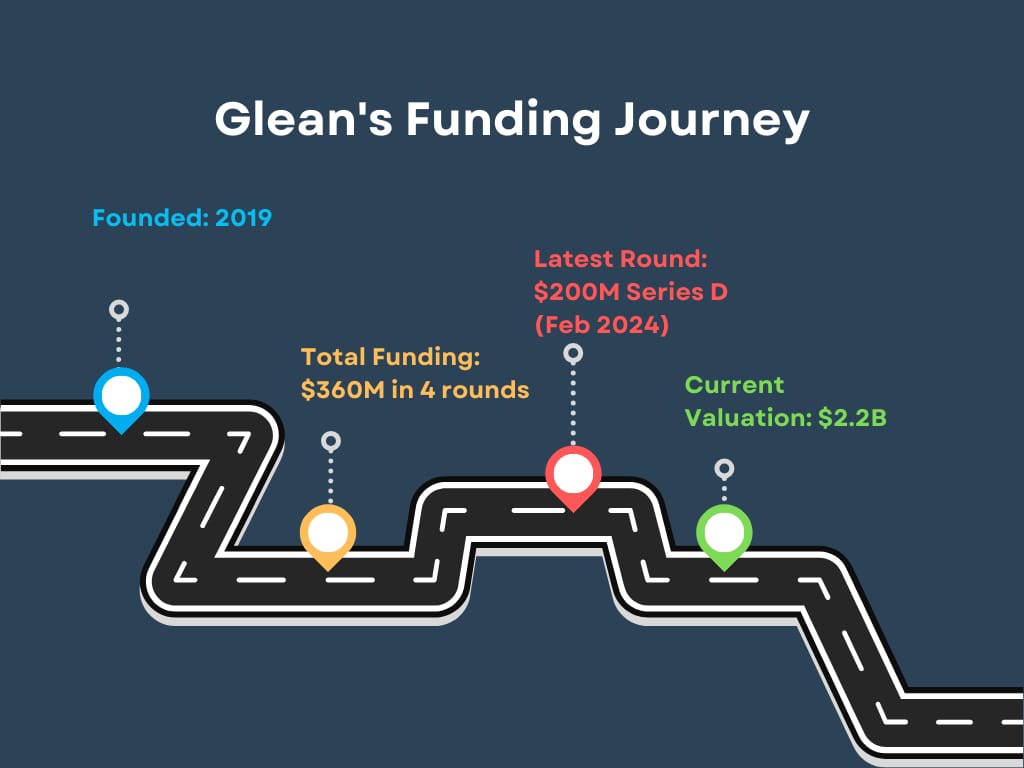

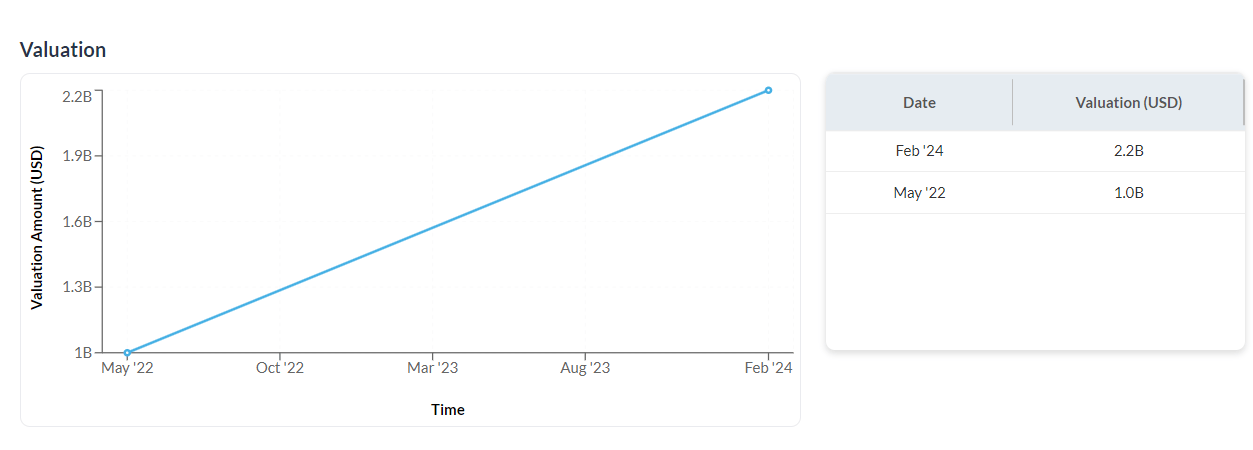

With their recent $200M Series D funding and a $2.2B valuation, Glean is poised for significant growth. They're not just improving enterprise search; they're reshaping how businesses interact with their digital knowledge!🚀

Credits: tracxn.com

Glean's journey from a startup to a major player in just a few years demonstrates the power of innovative thinking in the B2B SaaS space. As they continue to evolve, Glean is set to play a crucial role in enhancing workplace productivity across various industries. 🌟

🗝️Here are some key takeaways from Glean's journey:

💡Glean's investor roster involves key investors like Lightspeed Venture Partners, Sequoia Capital, General Catalyst, etc.

With its India launch, @glean, a US-based #AI company, aims to empower Indian enterprises with cutting-edge AI technologies and expand across the Asia-Pacific, forging strategic partnerships with top firms.

Read more: bit.ly/3VXPewd

#InvestInIndia#TrendingNews

— Invest India (@investindia)

6:56 AM • Jul 15, 2024

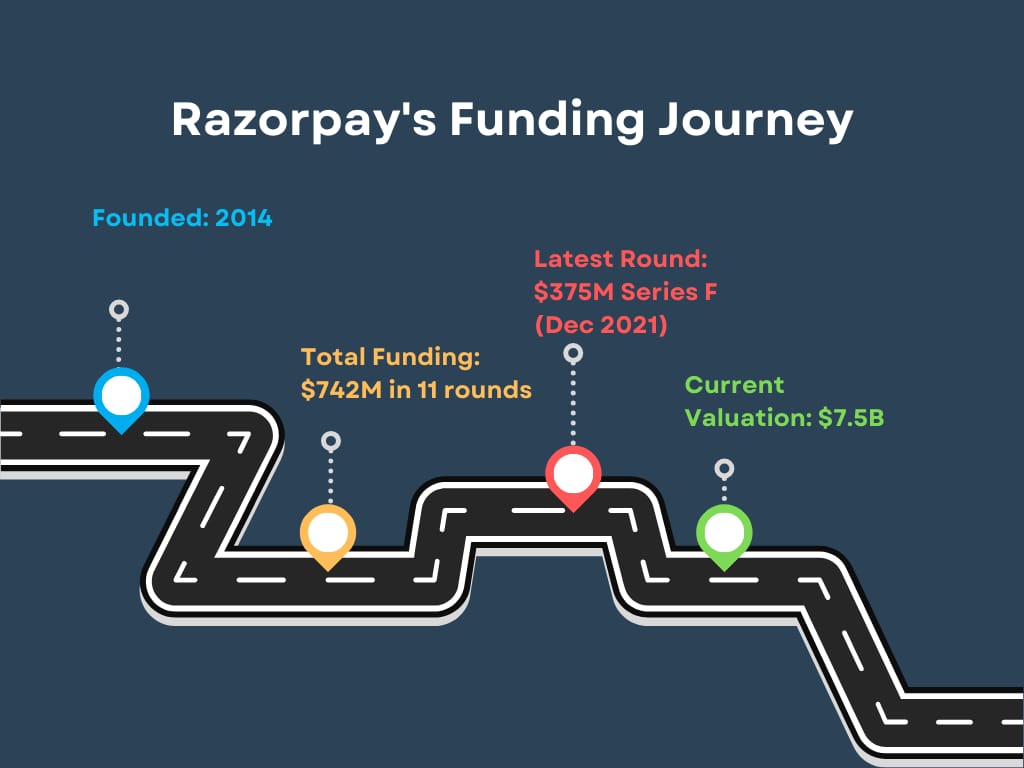

Razorpay - Transforming India's Financial Landscape 💸

Back in 2014, two IIT Roorkee grads, Harshil Mathur and Shashank Kumar, looked at India's online payment scene and thought, "We can do better." Fast forward to today, and Razorpay isn't just a payment gateway; it's become the financial backbone for Digital India.💳

From powering payments for tech giants like Facebook and Ola to enabling small businesses across India, Razorpay has become a crucial player in the country's digital economy. 💼💰

Razorpay's market position currently stands as:

🏆️Ranked 2nd among 825 competitors in the fintech space

🏢Serves over 10 million enterprises

What's cooking in Razorpay's kitchen?🍽️

1. 💼Full-stack financial solutions: Not just payments, but banking too!

2. 🔄Subscription model: Handling recurring payments with flexibility

3. 🌍International reach: Supporting 100+ currencies

4. 🏢Industry-specific solutions: From e-commerce to insurance

💪Now, let's dish out some insights for our savvy investors and ambitious founders:

Razorpay is expected to reach $175.30B by 2028 with a 4.31% CAGR from 2024-2028 📈

Credits: tracxn.com

Razorpay is on a recovery path.

In the seven months since it came out of RBI’s embargo on onboarding new merchants, Razorpay has bagged some big names in its portfolio.

The fintech's focus on growth means its priority now is to get more revenues and not cut costs.

— The Ken (@TheKenWeb)

3:02 PM • Aug 6, 2024

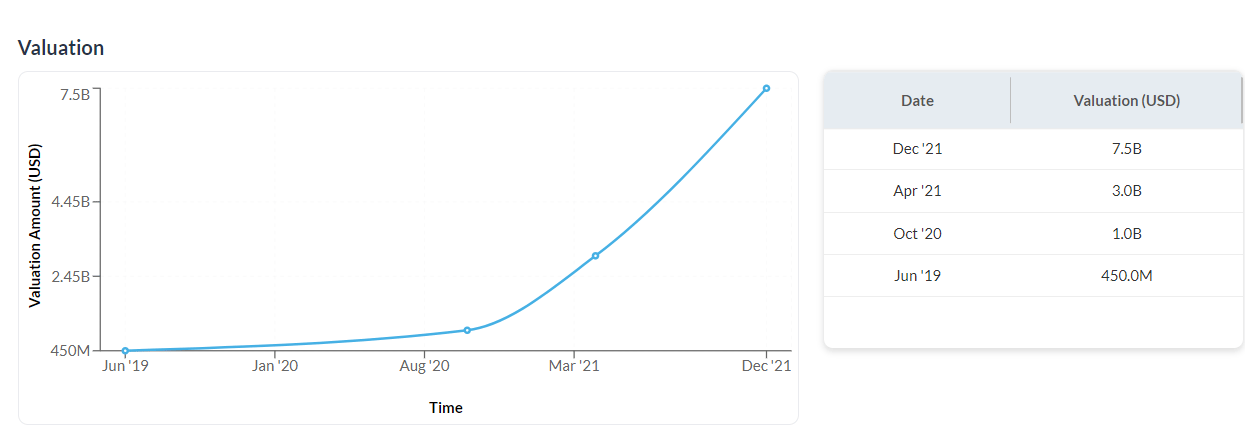

Remember, while Razorpay's journey from a startup to a $7.5B fintech giant is impressive, it's part of a rapidly evolving sector. Investors and founders should closely monitor market trends, regulatory changes, and competitive dynamics in this fast-paced industry. 🚀📊

That’s me when I see you refer! You can forward this email and ask them to click the link 🙏🙏. | I pour my heart into crafting this email every week for free. It would mean the world to me if you could share Rustic Flute with just one person you think would love it, too. Here's your unique referral code: |

What do you think of this email? |

Thank you for participating in our polls! 🙏 and to our 11 dedicated poll responders, we see you and truly appreciate your active engagement. 🌟 Your involvement means a lot. As we grow, I promise I won’t forget your support and engagement in the early days. 🚀

It has been a pleasure! I will see you next week. Until then, Stay motivated! Stay strong! Cheers!

Reply